MCX Silver Hits Record High: India’s bullion market witnessed a historic moment as silver prices on the Multi Commodity Exchange (MCX) surged to an all-time high of ₹1,82,000 per kilogram on 3 December. This significant milestone reflects a combination of global economic dynamics, investor sentiment, and domestic market conditions. As precious metals regain their shine, traders and investors are now closely monitoring what lies ahead for silver.

A Strong Rally Leading Up to December

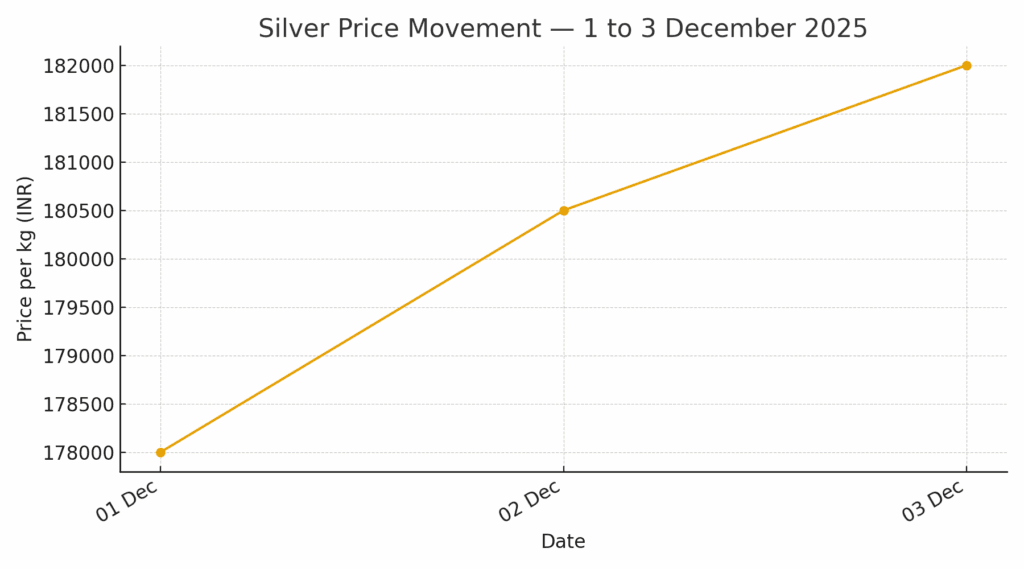

In the days leading to the record high, silver consistently demonstrated bullish momentum. On 1 December, prices were hovering near ₹1,78,000/kg, followed by a rise to about ₹1,80,500/kg on 2 December. This steady climb created a strong foundation for the major breakout seen on 3 December.

Below is a simple chart depicting silver’s upward movement from 1 to 3 December:

What Triggered the Latest Spike?

1. Global Precious Metal Rally

World markets have seen renewed interest in precious metals as uncertainty grows regarding global economic stability. With inflation pressures lingering and central banks signaling a slower pace of rate hikes, investors are diversifying their portfolios away from equities and toward commodities like gold and silver. As a result, silver prices have mirrored the global uptrend.

2. Industrial Demand on the Rise

Silver is not just a safe-haven metal; it is also a key industrial component, especially in sectors like electronics, solar energy, and electric vehicles. As production in these sectors expands, the demand for silver continues to strengthen, contributing to the price surge.

3. Weakening Dollar Index

A softer US dollar has also boosted the appeal of precious metals. Since silver is globally traded in dollars, a weaker dollar makes it more affordable for international buyers, thereby lifting overall demand and market prices.

4. Strong Domestic Investment Activity

Indian investors have increasingly turned to silver as an alternate asset class. With gold prices already hitting record highs earlier, silver is now gaining traction due to its relatively lower cost and higher volatility, which can offer better short-term returns.

What Does This Mean for Investors?

The surge past ₹1,82,000/kg signals strong momentum, but investors should tread carefully. While the long-term outlook remains positive due to industrial demand and macroeconomic factors, short-term corrections are likely as markets react to global data and central bank announcements.

For those considering entering the silver market, it may be wise to monitor dips or consolidation phases. Meanwhile, long-term investors may find this rally encouraging as silver continues to position itself as both a precious and industrial metal with multifaceted demand. check our silver rate forecasting analysis to make your financial design.

Conclusion

The record-breaking rise of MCX silver to ₹1,82,000/kg marks an exciting moment for India’s bullion market. Whether driven by global trends, industrial demand, or domestic investment enthusiasm, silver is clearly in the spotlight. As we move deeper into December, all eyes will remain on how the metal performs and whether it can sustain or even surpass its new peak.

Angel One (Trading & Demat Account)

Angel One (Trading & Demat Account)