FinNifty Today (Spot)

| FinNifty Spot |

| 28,458.60 ( 0.88% ) 248.00 As on: 23-02-2026 | 15:30 IST |

FinNifty Forecast Today 24-02-2026

| Trend – Negative | Previous Close: 28,455.00 |

FinNifty is trading slightly downward today, showing a cautious market mood. The index is moving between 27,127 and 27,684, with key support around 25,251 and resistance near 27,584. If it breaks above 27,584, we might see some downward movement tomorrow. Traders should watch for any changes in financial sector stocks, as they can influence FinNifty’s direction.

FinNifty Resistance / Support

| Resistance | R1 | R2 | R3 |

| 28,566.60 | 28,681.10 | 28,799.70 | |

| Support | S1 | S2 | S3 |

| 28,333.50 | 28,214.90 | 28,100.40 |

| FinNifty Range | ||

28,118 |

| 28,774 |

FinNifty Future Forecast for Today, 24-02-2026

| Resistance | R1 | R2 | R3 |

| 28,597.70 | 28,751.90 | 28,953.60 | |

| Support | S1 | S2 | S3 |

| 28,241.80 | 28,040.10 | 27,885.90 |

Spot Bank Nifty

61,284.50 ( +0.18% ) +112.50

As on: 23-02-2026 | 15:30 IST

Bank Nifty Forecast Today

| Trend – Positive | Previous Close: 61,275.05 |

Bank Nifty Resistance / Support (24-02-2026)

| Resistance | R1 | R2 | R3 |

| 61,518.85 | 61,762.65 | 62,007.50 | |

| Support | S1 | S2 | S3 |

| 61,030.20 | 60,785.35 | 60,541.55 |

| Bank Nifty Range | ||

60,575 |

| 61,972 |

Spot Nifty

25,710.50 ( +0.54% ) +139.25

As on: 23-02-2026 | 15:30 IST

Nifty Forecast Today

| Trend – Negative | Previous Close: 25,713.00 |

Nifty Resistance / Support (24-02-2026)

| Resistance | R1 | R2 | R3 |

| 25,784.65 | 25,859.10 | 25,946.75 | |

| Support | S1 | S2 | S3 |

| 25,622.55 | 25,534.90 | 25,460.45 |

| Nifty Range | ||

25,419 |

| 25,962 |

Spot Sensex

83,285.68 ( +0.57% ) +470.97

As on: 23-02-2026 | 15:30 IST

Sensex Forecast Today

| Trend – Negative | Previous Close: 83,294.66 |

Sensex Resistance / Support (24-02-2026)

| Resistance | R1 | R2 | R3 |

| 83,551.17 | 83,808.32 | 84,130.49 | |

| Support | S1 | S2 | S3 |

| 82,971.85 | 82,649.68 | 82,392.53 |

| Sensex Range | ||

82,289 |

| 84,104 |

Spot Gift Nifty

25619.00 ( -0.40%) -103.00

As on: 23-02-2026 | 22:30 IST

Gift Nifty Forecast Today

| Trend – Positive | Previous Close: 25,880.50 |

Gift Nifty Resistance / Support (24-02-2026)

| Resistance | R1 | R2 | R3 |

| 25,849 | 25,899 | 25,958 | |

| Support | S1 | S2 | S3 |

| 25,739 | 25,680 | 25,630 |

| Gift Nifty Range | ||

25,576 |

| 25,887 |

What is FinNifty Forecast?

Stock market indexes are collections of selected stocks that typically represent a specific sector. They reflect the performance of the underlying stocks and allow you to invest in a diversified portfolio. As a result, if stock prices rise, the index increases as well. There are many indices in the Indian Stock Market and the top two are BSE Sensex and NSE Nifty. FinNifty is another index representing the financial market performance in the Indian economy.

FinNifty is the Nifty Financial Services Index. This index was established in January 2021 and includes various financial stocks. It was created to monitor the performance of equities in the Indian financial industry, which covers sectors such as banks, financial institutions, NBFCs, insurance companies, housing finance, and other financial services companies.

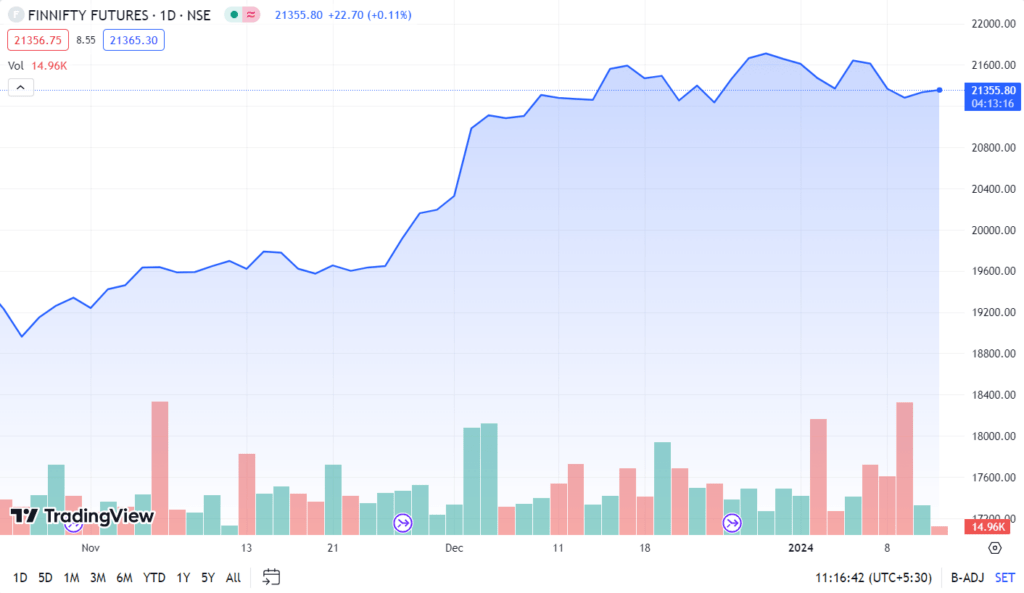

FinNifty Live Index Chart

The FinNifty chart is a graphical representation of the performance of the FinNifty Index in the Indian stock market. It offers investors visual support to recognize and analyze the movement of this index. The Nifty Financial Services Index (FinNifty Index) was launched by NSE in 2017. They formed a combination of 20 companies from the financial service sector including banks, NBFCs, insurance companies, and other financial institutions.

Constituents of FinNifty

Constituent means the stock of a company that is included in the index and helps in determining the index value. Each constituent’s weight in the overall index is determined by market capitalization. The FinNifty index is built using the free float market capitalization approach. In this approach, a company’s valuation is based only on the outstanding shares held by the public. Shares owned by promoters, trusts, government, directors, etc. are not taken into consideration. The base value of this index is 1000.

Free float market capitalization = Outstanding shares X Price X IWF

Here, IWF is the Investible Weight Factor, where greater IWF indicates that there are more shares listed under public shareholding. Each stock’s weight is determined by the free float market capitalization factor and the weightage keeps changing. Every six months, this weightage will be rebalanced. This index is administered by the National Stock Exchange (NSE) and stocks for this index are chosen using a long process.

Here is the list of FinNifty stocks, along with their weightage:

| S.No. | FinNifty Stocks | Industry | Value (in lakhs) |

|---|---|---|---|

| 1. | HDFC Bank | Banks | 3,54,264.60 |

| 2. | ICICI Bank | Banks | 1,68,094.60 |

| 3. | State Bank of India | Banks | 1,29,612.23 |

| 4. | Kotak Bank | Banks | 75,820.29 |

| 5. | Axis Bank | Banks | 60,749.97 |

| 6. | Shriram Finance Ltd. | NBFC | 57,050.07 |

| 7. | Bajaj Finance Ltd. | NBFC | 51,089.29 |

| 8. | HDFC Life Insurance Company Ltd. | Life & health insurance | 38,742.65 |

| 9. | Cholamandalam Investment & Finance Company Ltd. | NBFC | 19,979.82 |

| 10. | Bajaj Finserv Ltd. | Financial Services | 18,777.35 |

| 11. | HDFC AMC Ltd. | Financial Services | 16,549.88 |

| 12. | Power Finance Corporation Ltd. | Finance term lending | 12,822.75 |

| 13. | ICICI Lombard General Insurance Company Ltd. | General Insurance | 12,649.18 |

| 14. | ICICI Prudential Life Insurance Company Ltd. | Life Insurance | 10,496.21 |

| 15. | REC Ltd. | Finance term lending | 9,834.14 |

| 16. | SBI Life Insurance Company Ltd. | Life & health insurance | 6,847.85 |

| 17. | SBI Cards and Payment Services Ltd. | NBFC | 6,622.53 |

| 18. | Indian Energy Exchange Ltd. | Financial Services | 4,345.17 |

| 19. | LIC Housing Finance Ltd. | Housing Finance Company | 4,163.65 |

| 20. | Muthoot Finance Ltd. | NBFC | 2,293.96 |

Source: NSE India, Jan 2025

Advantages of Investing in FinNifty

- The financial services sector is a growing sector and if you are bullish about the overall finance sector, then it is a good option for you.

- Another important factor is diversification. By investing in various companies, you can diversify your portfolio and minimize your risk connected with investing in individual equities.

- The Nifty Financial Services index has provided stable and good returns since its inception. As a result, it would be an excellent addition to your portfolio.

- There is a huge potential in the financial services sector and it has given 21.62% returns in the last 1 year.

- The FinNifty index is extremely liquid, thus, you can readily purchase and sell shares in the index at any moment during trading hours.

Disadvantages of Investing in FinNifty

- There are a limited number of stocks in the Nifty Financial Services index and if any of them underperforms, then there is a chance of concentration risk.

- Due to regulatory and economic factors, you may see volatility in the Financial services companies, and in the FinNifty index.

- FinNifty index only contains large-cap companies, therefore it does not provide exposure to small-cap equities.

How to Invest in FinNifty?

To invest in FinNifty, you must first open a Demat account with a reputable stock broker. There are different ways to invest in FinNifty:

Futures & Options (F&O): The FinNifty index can be traded using derivatives such as Futures and Options. This allows you to make hedges and speculate. For a monthly contract, the expiration date of Fin Nifty derivates is the last Tuesday of the month. However, it might be a risky option for inexperienced investors, as they might lose their money.

Index Fund or Exchange Traded Fund (ETF): You may decide to invest in mutual funds or ETFs that track the FinNifty stocks. Some of the top mutual funds in this category are ICICI Prudential Banking and Financial Services Fund, Invesco India Financial Services Fund, UTI Banking and Financial Services Fund, etc. And the top ETF scheme comprising of FinNifty stocks is Mirae Asset Nifty Financial Services ETF.

Individual FinNifty stocks: You can buy stocks of specific firms that are listed on the FinNifty index. You need to buy the same stocks mentioned in the index in the same weightage. This will be a time-consuming process and you need to accept the risk that is associated with the selection of individual stocks.

Difference between FinNifty and Bank Nifty

- Bank Nifty is comprised of 12 banking stocks, where each stock’s weight is determined by its market capitalization. It only contains the banking stocks. However, FinNifty takes it a step further. It is comprised of 20 stocks, which not only contain banking stocks but include NBFCs, financial institutions, insurance companies, housing finance, and other financial services companies.

- Both FinNifty and Bank Nifty are volatile because they consist of fewer stocks as compared to Nifty 50. However, it is seen that Bank Nifty is more volatile than Fin Nifty because it includes only the banking stocks.

- FinNfity has demonstrated better returns, great performance, and broad exposure if compared to Bank Nifty. Also, the FinNifty index is more diversified than the Bank Nifty index.

Important points to consider before Investing in Fin Nifty

- Each stock can weigh only 33% and the cumulative weightage of the top 3 stocks in the Fin Nifty index should not surpass 62%.

- Rebalancing of Fin Nifty stocks is done on a semi-annual basis.

- Fin Nifty only looks into companies that are part of the Nifty 500 index.

- There is a freeze limit for Fin Nifty, which is set by NSE and this limit is reviewed and announced every month.

- Fin Nifty is the 1st index derivative that includes a weekly futures contract as well as weekly options.

Should you Invest in FinNifty? Is FinNifty right for you?

The FinNifty index is sectoral-based and thus contains a high level of risk and volatility. So, it is suitable for investors who are bullish on the financial services sector like banks, NBFCs, etc. As we know, there are different ways to invest in FinNifty and if you are an experienced trader then only you should invest through derivatives contract. If you are a newbie and do not have much experience in stock markets and still want to make a bet on FinNifty, then you can go for mutual funds or ETFs.

Closing Thoughts

At last, we can conclude that the FinNifty index is useful to diversify your portfolio which allows you to invest in the financial services sector. While investing in the FinNifty index, it is critical to monitor economic and political factors because they will have an impact on FinNifty stocks. It is also essential to have a disciplined attitude to trading or investing. Over time, a sound fundamental grasp of the market, combined with experience and patience, can provide good results. So far, FinNifty’s performance has been more positive than Nifty 50 and Bank Nifty, luring more investors and traders to the NSE.

FAQs – Fin Nifty Index

Q1. What is FinNifty?

Ans. FinNifty or Financial Services Index is an index of the National Stock Exchange tracking the performance of the financial services industry. An extensive list of stocks includes banking, insurance, and financial services industries’ stocks, amongst others.

Q2. How is FinNifty different from Nifty?

Ans. While FinNifty limits itself to the financial services sector, Nifty is a broad-based index that encompasses several sectors. While the Nifty index is rather broad, it allows for a more focused and relevant benchmark that is specific to the Financial sector Companies.

Q3. Which sectors are included in FinNifty?

Ans. Sectors like asset management, banking, insurance, and many more related sectors are a part of FinNifty. It extends to enterprises in the financial and investment sectors and related financial activities.

Q4. What factors influence FinNifty movements?

Ans. This includes interest rates, legislative adjustments, availability of credit, business profits of the financial sector, and trends in the FinNifty markets. Changes specific to a sector and changes in policy, too, are significant.

Q5. How often is FinNifty rebalanced?

Ans. The rebalancing of FinNifty occurs during the periods of March and September on a semi-annual basis. Reviewing the constituent stocks with reference to their market capitalizations and trading activities in the financial services sector helps in the rebalancing.

Q6. What are the advantages of investing in FinNifty?

Ans. Thus, investing in FinNifty generates sector-specific exposure to the financial service industry in addition to diversification in the financial stock basket or can yield higher returns in the event of sector growth. It is useful and appropriate for investors seeking opportunities in a particular field of operation.

Q7. How can investors track FinNifty performance?

Ans. The FinNifty can be tracked using market analysis reports common on websites such as NSE, FinNifty websites, and business and financial news platforms. Information about changes in the indices can be received in real time, by tracking the fluctuations in the financial indices and through the employment of financial news applications.

Q8. What are the risks associated with investing in FinNifty?

Ans. They exist in the form of interest rate fluctuations, their impact relative to varying industry conditions, changes in regulations, and economic ups and downs that affect the financial industry. Some of the risks could be the changes in consumer behavior toward financial firms as well as financial crises.

Q9. How can technical analysis help predict FinNifty movements?

Ans. It denotes a relative appraisal of the FinNifty in terms of price charts, volumes of trade, and historical patterns, which enables it to predict changes. In using such indicators as the Bollinger bands, RSI, or the moving average, trends and directions that may be favorable for trading are identified.

Q10. What role does government policy play in FinNifty’s performance?

Ans. This is because FinNifty tracks the financial services industry, which means rules initiated by the government could influence aspects such as growth rates, profitability, and business conditions. These policies include bills, taxes, regulations, and other economic measures.

Q11. Is FinNifty affected by global financial trends?

Ans. Yes, about the changes in the key rates of major central banks, the overall economic development environment, and, of course, the stability of financial markets, FinNifty is adjusted. Specifically, these developments may influence inflows of capital to the financial industry and the sentiment of investors.

Q12. How does corporate earnings season impact FinNifty?

Ans. This is due to the volatility experienced by FinNifty, which is related to the reaction of investors to the financial companies’ earning season. This means that while FinNifty can soar if earnings reports signal healthy figures, it may plummet if poor earnings are reported, which reflects the market’s sentiment toward financial stocks.

Q13. What are some key financial indicators to monitor for FinNifty forecasting?

Ans. Among the key financial parameters which are used to forecast FinNifty are interest rate spread, credit growth, bad loans, and return on assets in the financial sector along with gross domestic product and inflation rates.

Q14. Can FinNifty be used as a benchmark for financial sector performance?

Ans. Indeed, FinNifty has been serving as a standard of the financial industry providing relevant information about tendencies, health conditions, and comparative indicators to other indexes.

Q15. How does dividend yield impact FinNifty investors?

Ans. Regarding dividend yield, the FinNifty affects the investment decisions of investors and allows them to make more informed decisions based on the income from financial stocks in comparison to their price. It could benefit from having a higher dividend yield, because it may attract income-focused investors and support stock prices.

Q16. What are the historical returns of FinNifty compared to other indices?

Ans. The success of the financial services industry, which can be more volatile than more general market indices like Nifty, is reflected in FinNifty’s historical returns. It has, nevertheless, demonstrated times of rapid expansion during advantageous financial market circumstances.

Q17. Is it advisable to invest in FinNifty during economic downturns?

Ans. There is the risk associated with buying the FinNifty throughout recessions due to feasible decreases in the efficiency of the monetary industry. If monetary supplies are low-cost throughout declines it can additionally offer possibilities for long-lasting returns.

Q18. How does liquidity impact FinNifty trading?

Ans. Since it impacts exactly how basic it is to acquire coupled with offer index parts liquidity has an effect on FinNifty trading. While reduced liquidity could lead to even more volatility as well as trading prices high liquidity ensures effective rate exploration and also tighter spreads.

Q19. What are the top holdings in FinNifty currently?

Ans. Leading suppliers of monetary solutions, such as HDFC Bank, ICICI Bank, and SBI together with Kotak Mahindra Bank, are regularly among FinNifty’s leading holdings. The current rebalancing as well as the state of the marketplace might have an effect on the structure.

Q20. How does investor sentiment affect FinNifty volatility?

Ans. FinNifty volatility is influenced by financier belief which affects acquiring together with marketing choices. Costs might climb as a repercussion of a favorable state of mind while sell-offs might take place as an outcome of an unfavorable view enhancing volatility together with market swings.

Angel One (Trading & Demat Account)

Angel One (Trading & Demat Account)