The Indian stock market is gearing up for one of the most dynamic years in its history. After a milestone-filled 2025, 2026 is on track to become the “Year of the Mega IPOs.” With SEBI simplifying listing norms and domestic liquidity hitting record highs, several industry giants and high-growth startups are preparing to make their public market debut.

Whether you’re a seasoned investor or a newcomer looking for the next multibagger, here is the ultimate, SEO-friendly guide to the most awaited IPOs of 2026.

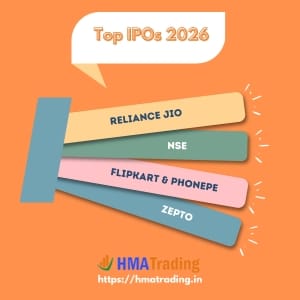

Mega IPOs That Will Shape India’s Stock Market in 2026

2026 is set to witness some of India’s biggest public listings, with market giants and tech leaders preparing to hit the IPO market. These mega issues are expected to redefine investor sentiment and reshape the country’s market landscape.

1. Reliance Jio IPO: India’s Most Awaited Listing

The most anticipated IPO in Indian history, Reliance Jio, is expected to list in the first half of 2026. Analysts peg its valuation between ₹10.8 lakh crore and ₹14.1 lakh crore.

Why it matters:

- India’s largest digital ecosystem

- Massive presence in telecom, 5G, and home entertainment

- Huge retail and institutional investor interest

This IPO could redefine India’s technology and telecom landscape.

2. NSE IPO: A Landmark Market Event

After years of regulatory roadblocks, the NSE IPO is finally expected to go live in 2026. With an estimated valuation of ₹4.75 lakh crore, investors will get a rare opportunity to own equity in India’s most influential stock exchange.

Key highlights:

- Leader in equity trading volume

- Strong revenue visibility

- Robust financials and corporate governance reforms

3. Flipkart & PhonePe IPOs: Walmart’s India Power Duo

Two of India’s biggest digital players are gearing up for their long-awaited listings.

Flipkart IPO

- Expected valuation: $60–70 billion

- Will set the benchmark for India’s e-commerce profitability

- Strong market share and growing logistics infrastructure

PhonePe IPO

- Expected valuation: $12–15 billion

- Dominant player in UPI, mutual funds, and insurance distribution

- Fastest-growing fintech in India

Both IPOs represent the next phase of India’s digital revolution.

4. Zepto IPO: Quick-Commerce Disruption Continues

Zepto, the startup that made 10-minute delivery a lifestyle, is preparing for a blockbuster listing in 2026. It aims to raise around ₹11,000 crore.

Why investors are excited:

- Rapid expansion of the dark-store network

- High repeat usage

- Strong brand positioning in urban markets

Zepto is a top pick for growth-focused investors.

5. SBI Mutual Fund IPO: A Safe-Bet for Long-Term Investors

As India’s biggest asset management company, SBI Mutual Fund is expected to list with a valuation close to ₹1 lakh crore.

Why it’s a safe bet:

- Trusted brand with a massive retail customer base

- Record SIP inflows in the Indian mutual fund industry

- Attractive long-term growth potential

Why 2026 Is a Turning Point for IPO Investors

The upcoming IPO pipeline marks a dramatic shift from “growth at any cost” to “profitable, sustainable growth.”

Companies like OYO and boAt—once criticised for losses – are returning stronger, with leaner operations and clearer profitability roadmaps.

Investor Checklist: What to Evaluate Before Applying for IPOs

Before applying for any IPO, here are the top 3 metrics to evaluate:

1. Path to Profitability

Investors in 2026 are no longer funding large losses.

Rule of thumb:

If a company isn’t EBITDA-positive, ensure the DRHP outlines a clear 4-quarter profitability plan.

Insight:

IPO data shows that profitable tech companies outperform loss-making peers by nearly 40% in the first year of listing.

2. Understanding Grey Market Premium (GMP) Risks

A high GMP signals demand, but can also mean a post-listing correction.

Tip:

If the GMP exceeds 50% of the issue price, brace for potential profit booking within 30 days of listing.

3. Promoter Skin in the Game

Check how much equity founders and PE investors retain post-IPO.

Red flag:

If insiders are selling over 75% of their holdings, the company may be overvalued.

Final Thoughts

With powerhouses like Reliance Jio, NSE, Flipkart, PhonePe, and SBI Mutual Fund preparing to go public, 2026 is shaping up as a milestone year for Indian capital markets.

Stay updated on:

- DRHP filings

- Price bands

- Allotment dates

This will help you navigate the busiest—and possibly most rewarding—IPO year India has ever seen.

Which is the biggest IPO expected in 2026?

Reliance Jio is slated to be the largest IPO of 2026, and potentially the largest in Indian history. With a valuation estimate exceeding ₹11 lakh crore, it is expected to surpass the record previously held by LIC and Hyundai India.

Can I apply for the Zepto IPO if they are still making a loss?

Yes, you can. However, SEBI regulations often require loss-making companies to reserve a larger portion of their IPO for Qualified Institutional Buyers (QIBs). As a retail investor, you should check the “Path to Profitability” section in their Red Herring Prospectus (DRHP) before bidding.

How can I increase my chances of IPO allotment in 2026?

Since mega-IPOs like Jio and NSE will be heavily oversubscribed:

Apply for one lot from multiple demat accounts (using family members’ PAN cards).

Ensure your UPI mandate is approved before the deadline.

Avoid applying at the very last hour to prevent technical glitches.

Is it better to buy shares on the listing day or wait?

If the Grey Market Premium (GMP) is excessively high (above 50%), the stock often sees “profit booking” a few days after listing. For long-term giants like Tata Capital or SBI Mutual Fund, waiting for the post-listing volatility to settle can often give you a better entry price.

What are the key sectors to watch in 2026?

The three “Hot Sectors” for 2026 are:

Fintech & Asset Management (PhonePe, SBI MF)

Quick Commerce & Logistics (Zepto, Shadowfax)

Digital Infrastructure (Reliance Jio, NSE)

Angel One (Trading & Demat Account)

Angel One (Trading & Demat Account)