Mutual funds are considered the most effective way to make your money grow in today’s fast-paced world. Be it any financial goal, a smart investment in mutual funds can help investors fulfill their dreams quickly. Mutual Funds offer several benefits like economies of scale, diversification, expert monetary investment, easy liquidity, transparency, and others.

What are Mutual Funds?

Put simply, mutual funds refer to a pool of money in which money is invested in different securities like debt instruments, equities, money market instruments, etc. The selection of the instrument largely depends on the ultimate objective of the Mutual Fund Scheme.

How do Mutual Funds work?

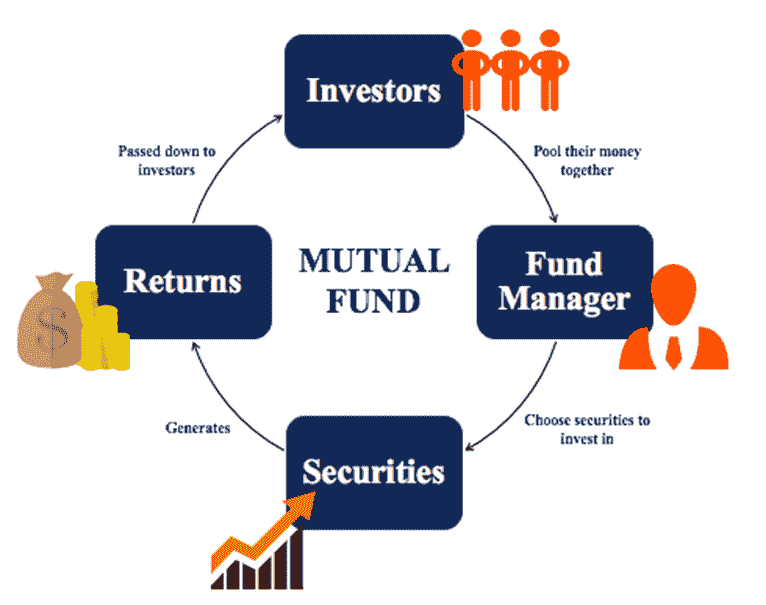

When you invest in a mutual fund, you combine your funds with those of other investors. A fund manager who makes investments in financial assets like stocks, bonds, etc. manages the money that you and other investors have pooled together. Every day, the mutual fund is handled. Below is a flowchart showing how mutual funds operate:

Types of Mutual Funds

In general, there are three types of mutual funds.

Debt Market Funds:

Debt funds make money by lending money to businesses and the government while also purchasing their debt-related securities. Based on the length of the lending period and the paper’s credit rating, these funds are divided into many categories.

Types of Debt Market Funds:

Money Market Funds – These mutual funds accrue returns by investing money in businesses or public securities for a period of up to a year.

Corporate Bond Funds – The funds are generated in these mutual funds by lending at least 80% of the money to companies that have top-rated debt docs.

Overnight Funds – By lending money to businesses or governments for one business day, these funds generate returns.

Liquid Funds – These funds earn their profits by making up to 91-day loans to businesses or governments.

Equity Funds:

One of the most widely chosen mutual funds in India, equity funds involve the investment of money in stocks. In addition, there are several kinds of equity funds, such as those that focus on a certain type of company, such as growth, value, large-cap, mid-cap, small-cap, or a mix of these stocks.

There are different types of Equity Funds:

Large Cap Funds – In these funds, a minimum of 80% of the money is invested in the top 100 companies in terms of market capitalization.

Mid-Cap Funds – In these mutual funds, at least 65% of funds are invested in the next 15 companies sorted on the basis of market capitalization.

Small-Cap Funds – These funds allocate at least 65% of their assets to businesses with market capitalizations of 251 and above.

Multi-Cap Funds – Each of the major, mid, and small-cap stocks are represented by at least 25% of the assets held by these funds.

Hybrid Funds:

Equity, debt, and gold are just a few of the asset groups that hybrid funds may invest in. Based on how much money they invest in various asset classes, hybrid funds can be divided into a number of distinct types.

Types of Debt Hybrid Funds:

Aggressive Hybrid – These funds must invest at least 65% of their assets in stocks, but they are not allowed to invest more than 80%. The remainder is owed.

Multi Asset Allocation – These hybrid funds spread out at least 10% of their total assets among at least three different asset classes, such as gold, debt, and equities.

Dynamic Asset Allocation Funds – These funds, also known as Balanced Advantage Funds, follow established asset allocation strategies and can hold up to 0–100% of their assets in either stocks or debt.

Arbitrage Funds – These funds use the chances of securities’ price discrepancies in several marketplaces to produce profits.

What are the Ways to Invest in Mutual Funds?

There are primarily two ways to invest in mutual funds:

SIP (Systematic Investment Plan):

SIP enables investors to invest a specific sum of money over time. Due to its high levels of convenience, SIP is one of the most suggested methods for investing in mutual fund schemes. Also, it aids in averaging the price at which you acquire the units of these funds. Find out more about Systematic Investment Plans (SIPs) here.

A systematic investment plan (SIP) is a way for people to get involved in mutual funds where they make periodic, automatic payments on a regular basis. You may plan your investments with SIPs to meet your long-term financial objectives. You may achieve this by choosing a mutual fund plan and deciding on the goal amount and the amount you’d like to invest at regular intervals.

Lumpsum:

A lump sum investment is one that you make once. People typically make lump sum investments when they get a big sum of money, such as bonuses or cash from the sale of an asset.

What are the Major Benefits of Investing in Mutual Funds?

Mutual funds emerged as a wonderful way to get amazing returns on investments. Mutual funds also give easy and quick access to people to invest in the share market without facing the technical complexity of the share market. However, there are lots of benefits mutual funds offer to investors. So, have a look at them.

Liquidity: The ability to redeem units at any moment is the key advantage of investing in a mutual fund for the investor. Mutual Funds, unlike Fixed Deposits, allow for flexible withdrawal, but it’s important to consider things like the exit load and pre-exit penalty.

Expert Management: A beginner investor could lack expertise and information on where and how to invest. The professionals run and manage mutual funds. The professionals gather funds from clients and distribute them among various assets, enabling the investors to make a profit.

The professional manages all the hurdles and maintains an eye on prompt entry and exit. One simply needs to spend, and one can rest easy knowing that the rest will be handled by those who are the best in their industry. One of the most significant benefits of mutual funds is this.

Diversification: An investment’s value cannot increase or decrease simultaneously. As one investment’s value rises, another one’s value might be falling. As a result, there is a lower likelihood that the portfolio’s overall performance will be volatile.

Diversification lowers the risk associated with creating a portfolio, thereby lowering the investor’s risk. As mutual funds are made up of a variety of securities, investor interests are protected in the event that one of the other securities they acquired declines.

Affordable Investment: The most significant benefit of mutual funds, among others, is their flexibility. To invest in a mutual fund, investors do not need to contribute a significant sum of money. Investments may be made based on cash flow.

If you are paid regularly, you should consider a systematic investment plan (SIP). Depending on your budget and convenience, a predetermined amount is invested through a SIP either monthly or quarterly.

Suited For All Financial Objectives: The best feature of mutual funds is that they require a minimum commitment of Rs. 500. And the maximum can be as much as the investor wants to put up.

When investing in mutual funds, one should only take into account their goals for investing, risk tolerance, income, and fees. Hence, regardless of income, everyone from any background is allowed to invest in a mutual fund.

Transparent & Safe: All products of a Mutual Fund have labels now that SEBI norms have been implemented. This implies that there will be color labeling for all Mutual Fund plans. This makes the entire investing process clear and safe by assisting the investor in determining the amount of risk associated with his investment.

Tax Savings: The finest alternatives for tax savings are offered by mutual funds. Section 80C of the Income Tax Act provides a tax exemption of Rs. 1.5 lakh per year for ELSS mutual funds. To be sure your tax strategy is necessary, utilize the income tax calculator.

According to the type of investment and the length of the investment, all other mutual funds in India are taxed.

Comparing ELSS Tax Saving Mutual Funds to other tax-saving options like PPF, NPS, and Tax Saving FDs, better returns are possible.

Lower Cost: Several people contribute money to a mutual fund, which is subsequently utilized to buy assets. Yet, because these funds are invested in assets, as opposed to just one transaction, one is able to reduce transactions and other expenses. The savings are transferred to the investors in the form of decreased Mutual Fund investment expenses.

Also, the price for Asset Management Services is reduced and split equally among all of the fund’s investors.

Lowest Lock-in Period: With only three years, Tax Saving Mutual Funds have the shortest lock-in periods. This is less than the maximum 5-year period for other tax-saving strategies like FDs, ULIPs, and PPFs.

Also, one has the choice to continue investing even after the lock-in period has ended.

Reasonable Tax on Returns: Under section 80C of the Income Tax (IT) Act, an equity-linked savings plan allows you to defer up to Rs. 1.5 lakh in tax payments each year. Depending on the fund form and term, all other varieties of mutual funds are taxed.

Before making an investment, one should consider the numerous benefits that mutual funds offer. The future results would be better if people were fully aware of the advantages of mutual funds.

Things To Consider While Investing in Mutual Funds:

If you are looking to invest in mutual funds, it is necessary that you consider all the underlying factors before arriving at a decision. Now, look at each & every factor you should look at

Investment Goal: First and foremost, you must choose a mutual fund that fits perfectly your investment objectives and risk acceptance. For example, in the case of long-term investments, equities mutual funds are advised since they offer the benefit of compounding over time. Debt or hybrid mutual funds might be a wise choice for short-term investments.

Performance Record: Take into account the mutual fund’s historical performance, but keep in mind that previous performance does not guarantee future outcomes. It is advised to examine returns over a range of time periods, such as one year, three years, five years, and ten years The impact of fees on your results will be lessened if you choose a mutual fund with a low-cost ratio. when examining returns. This will provide insight into the fund’s performance consistency. Selecting funds that have regularly surpassed their corresponding benchmark and category average is also advised.

Fund Manager: To ascertain the fund manager’s level of experience and investing philosophy, analysis his mutual fund’s fund management and prior performance. A fund manager’s effectiveness may be evaluated by examining the consistency of the mutual fund schemes’ performance, the amount of alpha the manager is able to produce over the benchmark and category average, and how well they have weathered market downturns.

Expense Ratio: The impact of fees on your results will be lessened if you choose a mutual fund with a low-cost ratio.

Liquidity: Choose a mutual fund with liquidity, which allows you to quickly purchase and sell shares as needed. The majority of mutual fund schemes, including ELSS and FMPs, have lock-in periods since they are open-ended. Prior to making a decision to invest in alternatives like ELSS or Fixed Maturity Plans, it is advised to take your liquidity requirements and time horizon into account.

Tax Benefits: Capital gains tax is applied to mutual funds. Thus, before investing, be careful to think about the tax ramifications. Equity mutual funds are regarded as tax efficient because they are kept for more than a year and are taxed at 10% with a 1 lakh rupee exemption. Conversely, debt mutual funds only receive the advantage of indexation and 20% taxation if they are held for more than three years. If you keep your debt funds for fewer than three years, you will be subject to the relevant tax rate for your slab.

Investment Pattern: Think about whether you would rather invest in a mutual fund that is actively or passively managed. Professionals oversee actively managed funds, which aim to outperform the market, while passively managed funds follow an index of the market. Global data on active vs. passive funds reveals that actively managed funds have outperformed index funds by roughly 66%, with a win-loss ratio of about 1:2. If we use statistics from the previous three years, this ratio appears to be closer to 1:1 in India. If we use data from the last four years, it is quite close to the 1:2 ratio.

What is a Mutual Funds Calculator?

An online Sip Calculator can help a person choose his sip monthly investment amount and the investment time period. By investing a sum of money for a given amount of time, you may also determine how much you might anticipate making.

You must enter the necessary data in the editable fields of the sip calculator for it to function. The monthly investment amount, estimated rate of return, and length of the investment are necessary pieces of information. Your sip return calculator’s total investment and total projected return will change as you alter these values.

A sip return calculator outlines how much you need to put aside each month and for how long in order to reach your objective. Your monthly contribution would be more if you invested for a longer period of time, and vice versa.

If you have a particular amount of money in hand every month that you wish to put in a sip, a mutual fund sip calculator will tell you how much you may make if you invest it for a given number of years. In this situation, you may determine how long you must spend in order to earn your target amount if any.

FAQs – Mutual Funds Sahi Hai

1. Do Mutual Funds Carry any Kind of Tax Liability?

Ans: Equity mutual funds that have been held for more than a year are subject to a 10% long-term capital gains tax on gains that exceed Rs. 1 lakh in a fiscal year.

Profits withdrawn up to one lakh rupees in a fiscal year are tax-free. If held for less than a year, investments in equity mutual funds are subject to a 15% short-term capital gains tax.

2. What does Exit Load Mean?

Ans: There are mutual fund schemes with exit loads and plans without exit loads. When investors redeem or withdraw their assets through exit load programs before the allotted term, a modest fee is applied.

3. What do Open-Ended, Close-Ended, and Interval Mutual Funds Mean?

Ans: Open-ended funds are ones that can be bought and sold at any time. Only during the new fund offering (NFO) period and after the closed-ended fund’s period has expired may closed-ended funds be acquired from the fund house. Interval funds have predetermined periodic times when they can be bought and traded.

4. How is Groww as a Mutual Fund Platform?

Ans: Groww was started as a dedicated mutual funds platform and later it expanded its portfolio by allowing investment in stocks as well. Despite this, Groww is still one of the pioneers in the mutual funds category and remains a wonderful choice for mutual funds investment.

5. Is there any Guarantee on Mutual Fund Returns?

Ans: Mutual funds make investments in equities, fixed-income assets, and other financial instruments. The value of these market-linked securities may increase or decrease depending on the numerous macroeconomic and microeconomic factors. Hence, mutual fund returns are not guaranteed.

6. What are Liquid/Money Market Funds?

Ans: These funds make investments in securities and money market instruments with extremely short maturities (less than 90 days). These funds often offer relatively steady returns to the consumers and are not much influenced by changes in interest rates.

Angel One (Trading & Demat Account)

Angel One (Trading & Demat Account)