The BSE Sensex is a stock market index that represents the performance of 30 leading and actively traded companies listed on the Bombay Stock Exchange (BSE). It offers a quick overview of market trends and serves as a key benchmark for assessing the overall performance of the Indian stock market.

Sensex prediction is the forecast of how the Sensex (India’s stock market index) may move in the short or long term, based on market trends, global cues, economic data, and investor sentiment.

Sensex Today (Spot)

| Sensex Spot |

| 82,241.09 ( -0.043% ) -34.98 As on: 26-02-2026 | 15:30 IST |

Sensex Forecast Today (27-02-2026)

| Trend – Negative | Previous Close: 82,248.61 |

Sensex Resistance / Support

| Resistance | R1 | R2 | R3 |

| 82,561.53 | 82,874.69 | 83,170.22 | |

| Support | S1 | S2 | S3 |

| 81,952.84 | 81,657.31 | 81,344.15 |

| Sensex Range | ||

81,377 |

| 83,173 |

Sensex Future Forecast for Today

| Resistance | R1 | R2 | R3 |

| 83,126.85 | 83,446.90 | 83,747.75 | |

| Support | S1 | S2 | S3 |

| 82,505.95 | 82,205.10 | 81,885.05 |

Spot Bank Nifty

61,124.60 ( +0.13% ) +81.25

As on: 26-02-2026 | 15:30 IST

Bank Nifty Forecast Today

| Trend – Negative | Previous Close: 61,187.70 |

Bank Nifty Resistance / Support (27-02-2026)

| Resistance | R1 | R2 | R3 |

| 61,376.70 | 61,566.45 | 61,848.15 | |

| Support | S1 | S2 | S3 |

| 60,905.25 | 60,623.55 | 60,433.80 |

| Bank Nifty Range | ||

60,372 |

| 61,726 |

Spot Nifty

25,492.60 ( +0.040% ) +10.10

As on: 26-02-2026 | 15:30 IST

Nifty Forecast Today

| Trend – Negative | Previous Close: 25,496.55 |

Nifty Resistance / Support (27-02-2026)

| Resistance | R1 | R2 | R3 |

| 25,579.05 | 25,662.00 | 25,751.05 | |

| Support | S1 | S2 | S3 |

| 25,407.05 | 25,318.00 | 25,235.05 |

| Nifty Range | ||

25,217 |

| 25,756 |

Spot Gift Nifty

25551.00 ( -0.07%) -17.00

As on: 27-02-2026 | 08:30 IST

Gift Nifty Forecast Today

| Trend – Positive | Previous Close: 25,638.00 |

Gift Nifty Resistance / Support (27-02-2026)

| Resistance | R1 | R2 | R3 |

| 25,778 | 25,919 | 26,022 | |

| Support | S1 | S2 | S3 |

| 25,534 | 25,431 | 25,290 |

| Gift Nifty Range | ||

25,380 |

| 26,008 |

Spot FinNifty

28,275.50 ( -0.23% ) -64.15

As on: 26-02-2026 | 15:30 IST

FinNifty Forecast Today

| Trend – Negative | Previous Close: 28,309.85 |

FinNifty Resistance / Support (27-02-2026)

| Resistance | R1 | R2 | R3 |

| 28,420.05 | 28,531.20 | 28,654.25 | |

| Support | S1 | S2 | S3 |

| 28,185.85 | 28,062.80 | 27,951.65 |

| FinNifty Range | ||

27,969 |

| 28,613 |

Besides, the stock market index of the Bombay Stock Exchange is Standard & Poor’s BSE Sensex simply referred to as the SENSEX of BSE 30. (BSE). BSE measures the 30 largest, most liquid, and traded stocks of Indian companies. The Sensex is live, and it reflects the total market capitalization of the thirty firms that make up Sensex.

The value of the 30 firms that constitute the BSE Sensex is the sum of the individual free-float market capitalizations of those firms. It is equal to the total market value of the 30 selected firms; it does not reflect the aggregate value of all the outstanding stock. Market capitalization base index relates the components to their respective market capitalization, through the float of the concerned index which is the Sensex in the present situation.

The base years taken for Sensex computations are 1978-1979 since the closing prices of these years are the average closing prices of the whole index when all the stocks were in their formative stage. This is obtained by including the current market values of the stocks with the value of the stocks during the base period in the given algorithm to arrive at the index value.

It is calculated once a day and then, it recalculates every fifteen seconds that the trading is on. Stock splits, right issues, and bonuses are reflected in index numbers after having been treated in the manner therein mentioned. It is adjusted due to the changes in the elements of the index as shown by the following analysis of the index.

It must also be noted that the term Sensex was created by the syndicated stock market analyst Deepak Mohoni in the year 1989. The BSE Sensitive Index then was at about 750 points The call was translated into action and the longest selling streak was launched in late February 2006 when the BSE Sensitive Index reached about 750 points. Senti is formed from the words Sensitive and Index where Sensitive means easily affected by the words and Index means guiding or a pointer.

Meaning of Sensex

BSE Sensex is one of the recognized and used indices to measure the performance of the stock market of India. Technically, Sensex is ranked highly and is looked at as a benchmark for the India stock market index. Hence, the name ‘Sensex’ is an amalgamation of two words ‘Sensitive’ and ‘Index’, and the name was actually given by Deepak Mohoni who is a stock markets analyst.

As for the index, the Sensex is also rebalanced biannually: in June and December hence making a representation of the progressing market condition. This review also makes sure that the index is stripped off the bottom performers and other companies that may undergo tremendous instability in their performance with time resulting in their removal from the exchange list.

Stockholders make use of the Sensex in order to access the performance of specific business ventures and mutual fund investment plans. Senesx is also used by analysts and investors to track the cycles of India’s economy and to study the patterns that are peculiar to particular industries. Market research analysts use the Sensex to especially get insights about the trend in the growth and development of the country’s stock market.

It is quite informative to turn now to the question: What is the history of Sensex?

The Bombay Stock Exchange was established in 1986 and it is the oldest stock index in India.

The BSE Sensex also has posted record achievements in its existence and the index touched a historical best of 30,024. 74 points in May 2018 and Leaf et al. The index also has similarly traced its volatility since the occurrence of this index dropped to its lowest level at 5,475. As low as 67 points in March 2020 due to the emergence of COVID-19 which had a negative impact on the Indian economy.

2008 again saw one of the worst falls in Sensex and what made it worse was the global financial crisis. The Sensex reached its high of 21,206 points in January 2008, but by October 2008 it had eroded to 8,701 points losing over 50 percent of its worth in a mere nine months. The Sensex increased very sharply after this drop; the Indian government implemented many measures to bring stability to the economy. But the Sensex soon started to recover and by the year 2009, the Sensex again was back to its pre-crisis phase.

Importance of Sensex

Market Barometer: Therefore, Sensex can be said to be the pointer of the general performance of the share market in India.

Investor Sentiment: It indicates the interest of investors towards a particular stock or any particular index and the rates of change of these interests.

Economic Indicator: It acts as a sign of economic progress and also as a monitor of the position of the economy at a specific time.

Benchmark: It is applied by fund managers and investors to evaluate their portfolios’ performance as a reference point.

Understanding of the Purpose of Sensex

The purpose of the Sensex is to act as a sensitive indicator of the stock market of India in order to assist individuals or groups of people in making investment decisions in the stock market.

The aim of developing the Sensex is to represent the benchmark of the performance of the index on the Indian stock exchange. The Sensex represents the index of the 30 largest and most trading companies in terms of shares in India’s Bombay Stock Exchange (BSE). The data used is long-term time series data based on the ‘free float market capitalization’ of the Sensex. This strategy ensures that the index value aligns with requirements toward the market capitalization of Businesses in the BSE.

Due to the centrality of the Sensex as an indicator of the performance of the market, investors, analysts, and politicians benefit from being able to assess it. Global investors tend to base their decisions on the prevailing trends in India through the Sensex, this economy has grown over the past few decades. Experts in the economy and investors apply it to indicate India’s business cycles and identify patterns in particular sectors.

In addition, the Sensex is useful in attracting FIIs to the Indian stock market for their participation in share buying. It is evident that these investors utilize this index as a way of predicting the future growth trends in the Indian economy so as to make relevant investment decisions depending on the changes in the index.

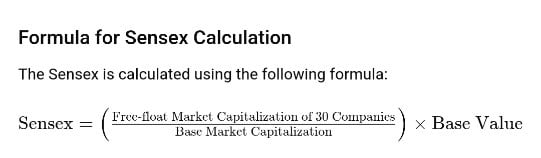

Calculation of Sensex

Market Capitalization

The Sensex being an index is computed based on free-float market capitalization. This method takes only into account the free-floating shares in the market, that is the shares that are tradable unlike those held by promoters, government, and other restrictive shareholders.

Free-Float Market Capitalization

Free-float market capitalization refers to the overall market value of the company’s equity out of the total shares it has that are available in the stock market for trading with promoters holding. It is calculated as:

Free-float Market Capitalization = Market Price

× Number of Free-Float Shares

Base Year and Base Value

For Sensex, the base year selected is 1978-79 and the base value fixed for the Sensex is 100. Today’s value of the Sensex is calculated based on the index of free float market capitalization of 30 companies with reference to the base year.

This formula allows for achieving the growth impact of the selected companies’ index in relation to the base time period.

This formula allows for achieving the growth impact of the selected companies’ index in relation to the base time period.

How does Sensex work?

The BSE Sensex is an important index that represents one of the leading stock markets and shows the changes of the 30 largest and most popular Indian companies that are listed on the Bombay Stock Exchange (BSE). Valued using the ‘free float market capitalization,’ Sensex has time series data for years of operation. This method entails the multiplication of the price for each stock with the number of shares that are available in the float. This approach offers a more accurate value for the totality of the companies’ worth and their added value for the index.

The Sensex is one of the widely employed benchmarks to analyze the world’s investors of the overall health of the Indian economy. The index has been in an upward trend basically mirroring the economic growth rate in India in the recent past. It has become one of the most rapidly developing countries due to factors such as a youthful population, an expanding middle-income population, and favorable government policies.

S & P launched the S & P BSE SENSEX with the objective of calculating the market rate of return of the top 30 stocks in the Indian Indices by market capitalization and turnover. Still, the changes related to its methodology have taken place during the last three decades under the growth of the Indian market, yet none of those changes influenced the goal of the index.

The last amendment introduced the DVR or different voting rights shares as eligible to be included in the index provided that they meet the size and the liquidity factors of the index’s methodology.

Index Construction

Companies that qualify to be included in the construction of the S&P BSE SENSEX are determined by the following measures. Universe: Any common stock of a company or DVR share of a company that participates in the S&P BSE 100 is allowed to be indexed.

Market Cap: Stocks should come from a constituency that ranks it in the top 75 concerning average 3-month float or total market capitalization.

Liquidity: For those that satisfy the eligibility criteria, the three-month moving-average daily value traded (ADVT) is determined and the cumulative weights are arrived at in order to arrive at the final eligible companies ADVT weight. Constituents with a cumulative weight of ADVT equal to or greater than 98 percent are removed from the index if those prospective constituents exist.

Minimum Float Weight: Constituents should have at least US$ 0. For the market cap and liquidity requirements, 50% of the fund size follows this section.

Sector Representation: The process of stock selection usually aims at keeping proportional representation similar to that of the given index.

Stock Selection: In the process of rebalancing, index constituents that do not meet free float to total market capitalization, total mid and small cap, ADVT along with minimum index weight criteria are lessened and substituted by constituents from the replacement list.Constituent Weighting: Float-adjusted market capitalization is used as the basis for equal weighting of every stock in the index. Reconstitution Frequency: The index is, therefore, rebalanced every six months, especially in June and December every year.

Factors that affect Sensex

The Sensex share index is very sensitive to many types of variables that might influence it. For the convenience of readers, they have been classified into three classes: global, sectorial, and country. Let us take a look at these factors in more detail: Let us take a look at these factors in more detail:

Macroeconomic factors

Other external factors like; interest rates, rate of inflation, and other foreign exchange rates also play an influential role in changing the Sensex. It is obvious that shifts in interest rates directly affect the cost that a firm uses when obtaining credit as well as the market view. Further, inflation, especially of a high degree, will lead to an increase in the various costs of input, thus making the company less profitable. Besides all these, variations in the exchange rates affect the company’s revenue from exports and expenditure on imports. This paper identifies the following as factors that can lead to a change in the Sensex’s price level.

Industry-specific factors

Some of the factors include the regulation of the index, Technological changes, and M&As all of which have an influence on the index. Technological evolutions and improvements influence the competitiveness and growth of a country, especially in the sector of telecommunication and information technology. However, the situation may change with the introduction of regulations, policies and even basic rules in the environment in which the company operates affects its operations and profitability. That is the meaning of mergers and acquisitions since they cause a change in the business and financial characteristics.

Company-specific factors

Other factors affecting the Sensex are specific to the companies that are involved in the calculation of the index such as changes in management, company’s performance, and market share. Information on Firm performance which includes aspects like revenue, earnings, and even the profit margins also influences the share prices and therefore alters the value of the Sensex. Forces such as changes in management, for instance through the appointment of a new chief executive officer, can shift a company’s focal strategic plan and consequently, influence stock prices. Also, there are changes in the distribution of market shares and competition between industries, affecting earnings and future growth rates.

Investing in Sensex

Direct Investment

Like any other stock exchange, investors can directly invest in the shares of the companies that are part of Sensex. This means to directly acquire the shares of the individual companies through a broker agent account. However, this approach involves a lot of research and monitoring of each of the companies.

Mutual Funds

Investors can also invest in mutual fund schemes launched by most of the special category mutual fund houses that track the Sensex. These funds collect money from an array of investors to buy a number of the Sensex stocks in what is usually called diversification. This way provides diversification as well as professional management of the investment resources.

Exchange-Traded Funds (ETFs)

Bearing this in mind, there are other ways through which one can invest in the Sensex that is through ETFs. They are quoted like companies that ply stocks in the stock exchange and come in diversified liquid forms.

Index Funds

Index funds are the mutual funds that aim at mimicking the Sensex. They provide an investment option where investors have little control over the funds; they also have lower fees than actively managed funds.

Futures and Options

Speculative traders and hedgers who are, or want to be familiar with the futures and options on the Sensex can find this article informative. These derivatives enable the investors to make a venture on the likely performance of the index.

Systematic Investment Plan (SIP)

SIPs in mutual funds/ETFs let investors invest a fixed sum in Sensex at fixed intervals systematically. This approach assists in creating an average cost for the investment and thus the blows of market swings do not affect much.

Sensex Forecast for 2026

India’s benchmark stock index will climb further by June and rally almost 9 percent in 2026, even as it hovers near record highs, 33 analysts surveyed by the news agency said, with most of them predicting no drop for the next three months.

The BSE Sensex index (. BSESN), opening a new tab, was trading almost in tandem with the US benchmark S&P 500 index, which rose 18. 7% last year on bets of lower interest rates in 2025 and of India’s outpacing its peers on the growth front.

Crossing the 73,000 for the first time in January, the benchmark index has risen more than 1 percent so far this year.

This is partly due to the decline of market anticipations for the U. S. Federal Reserve to bring forward rates from the start-of-cycle normalization path thereby causing emerging markets portfolio outflows.

The positivity prevailing in the stock market has also been possible due to the belief that the incumbent Bharatiya Janata Party government headed by Prime Minister Narendra Modi will be back into power in the next general polls.

Expectations of a new record were reflected in the Feb 12-21 weekly Reuters poll of 28 equity analysts, who predicted that the Sensex index of Indian stocks would increase another 4% to touch a high of 76,000 by June-end, well above the previous quote of 70,000 in November.

Thus, starting from 73,057 points as of the close on Tuesday, the index of the Bombay Stock Exchange is predicted to grow by 7. 5% to 78,550 by the close of the year 2025. So the answer would be roughly equal to 0.09 or 9% for the entire year.

The Indian economy still remains one of the ‘star performing’ economies in comparison to other emerging markets The author Neeraj Chadawar, head of quantitative equity research at Axis Securities also opines that the Indian economy is likely to sustain its growth trajectory in 2025 and will remain the ‘land of stability’ amid the, generally volatile economy of the world.

“The entire setup for the market is very constructive at this level because the market is focusing on policy continuity in the upcoming national level election.”

India is the second fastest-growing major economy and is estimated to grow about 6.8 percent this fiscal and over 6 percent in the next one or two years.

Twenty-five of 26 of the survey’s additional question respondents said they expected corporations would earn more over the following six months.

Most of the respondents, 16 out of 27 or nearly 60 % when asked about the chances of a market correction in the next three months said no to this notion and two of the respondents termed it highly impossible. As for the second: Nine felt it was probably or likely that their submission expediting would become a priority in the upcoming months … two considered it highly probable.

‘I don’t know whether there is a big correction coming,’ he said, ‘But I think India is blessed from a macro standpoint at the moment and the worries are a little bit about P/E being slightly high.’ Said Rajat Agarwal, Asia equity strategist at Societe Generale.

Currently P/E ratio stands at 24 on the BSE index which is on the higher side of the long-term average of 20; any further increase will only fuel more debate on the valuation concern.

According to the poll, the. The NSE index which opens Tuesday at 22, 750 will rise by more than 2 percent to 23,925 by the end of June 2026.

Conclusion

The Sensex is an essential barometer of the Indian stock markets together with the general economic performance of the nation. It is pertinent for the investors to grasp its definition, computation, operation as well as investment approach. Current business conditions are optimistic and corporate results are encouraging hence Sensex is predicted to advance in the year 2025. However, there are some issues, and investors should take into account some factors and make investigations when deciding to invest.

FAQs – Sensex

Q1. What do you expect to be in the year 2026?

Ans. According to the forecast Sensex in the year 2026 is expected to show a positive came by economic growth, technology development, and the performance of the sectors.

Q2. What are index funds and ETFs?

Ans. Index funds and ETFs are investment instruments in the form of mutual funds that aim to mimic the performance of an index, namely, the Sensex by investing in stocks that are a part of Sensex with the same weightage.

Q3. What is a Systematic Investment Plan better known as SIP?

Ans. A SIP implies investing a fixed sum of money at periodic intervals, and this methodology assists in gaining less sensitivity to volatility because it averages out the cost of investment.

Q4. What is the frequency at which the composition of Sensex is changed?

Ans. The nature of the Sensex is dynamic and changes periodically to reflect the market in its composition of esteemed organizations.

Q5. Which industries can be decisive for Sensex’s movement in 2026?

And. Sectors expected to dominate the market in 2026 are the technology sector, the financial sector, the health sector, and the consumer goods sector.

Q6. In what manner does the global market affect the Sensex?

Ans. Market factors related to the global market and specific economic conditions in a few crucial economic markets are responsible for its fluctuations in addition to investors’ attitudes towards it.

Q7. What is Sensex Prediction?

Ans. About BSE, there is the Sensex or the Sensitive Index that is taken from 30 of the largest and most active shares. From the above discussion, it can be concluded that it has a wide coverage as a measure of the broad health of the Indian stock market.

Q8. How is Sensex calculated?

Ans. Like Nifty, Sensex is arrived at through the Free-Float Market Capitalization method. It indicates the performance of the market by using the market value of all the 30 shares after proposing them to free float.

Q9. Why is Sensex important?

Ans. The Sensex is meaningful because it refers to a benchmark of India’s stock market, which gives an indication about the economy and sentiment of the market. This serves to either encourage or change investors’ decisions as well as economic policies by providing information on the performance of large Indian companies and sectors.

Q10. When was Sensex first calculated?

Ans. Originally, the base index value of Sensex was calculated on 1 April 1979. It has therefore over time grown to become one of the most widely recognized barometers of the Indian stock market.

Q11. Who regulates Sensex?

Ans. The Indian security market and its fair trading, accuracy, and investor safety are controlled by the organization referred to as the Securities and Exchange Board of India (SEBI) which is responsible for Sensex.

Q12. What factors influence Sensex movements?

Ans. They are affected by factors such as global market trends, business earnings, government policies investors sentiment, and even economic factors such as inflation. Other variables are the rates of interest, inflation, and political issues that may surface.

Q13. How often is Sensex updated?

Ans. It is recalculated as and when the trading is going on in BSE so that the recent stock prices and market situations are incorporated in the computation of the Sensex. It provides updated information on movements and trends in the industry.

Q14. What are Sensex futures and options?

Ans. Futures and options on Sensex are referred to as Sensex futures and options contracts which help investors in future expectations on Sensex or to hedge against them. It should be pointed out that these tools provide opportunities to earn money at different market conditions.

Q15. What is the historical performance of Sensex?

Ans. In the course of the longer period, Sensex has risen significantly but it has witnessed some probable cyclical fluctuations. For the growth and endurance of the Indian economy, it has been perceived as one of the most important indices even in the presence of unpredictable cyclical fluctuations of the stock markets.

Q16. How can one invest in Sensex?

Ans. Through futures and options traded on the Index, mutual funds that track the Sensex, and exchange-traded funds that are based on the Sensex, the Index is investible. For the same reason that Sensex is an index as opposed to a company’s stock or share, direct investments are impossible.

Q17. What is the difference between Sensex and Nifty?

Ans. As for now, Let Nifty is made up of 50 shares from the NSE while Sensex is made up of only 30 shares from the BSE. Although constituent offerings and sectoral representation are better with Nifty, Sensex has its origins from the early 90s and hence a longer track record.

Q18. Can Sensex predict economic trends?

Ans. Considering the nature of the Sensex as an indicator of market sentiment as well as corporate performance, it can serve as an excellent barometer of the trends observed in the economy. But it should be compared to other indexes of the economy because this is not the perfect forecast.

Q19. How does global market volatility affect Sensex?

Ans. Thus, Sensex can be influenced by capital movements, investors’ attitudes, and economic linkages because of global market conditions. Market shocks or events like; trade policies, geopolitical factors, and global financial crises are among the significant events that may trigger market reactions.

Q20. What are blue-chip stocks in Sensex?

Ans. All the stocks are reputable blue-chip companies with a good history of paying dividends, good financials, and comparably good profitability. Some of them are ITC, HDFC, and TCS.

Q21. What is the Sensex PE ratio?

Ans. The average relative price in the case of Sensex stocks is given by the ‘Sensex Price-to-Earnings (PE) ratio. The latest price can be compared with the average price to know if the index is relatively overpriced or undervalued.

Q22. How does dividend yield impact Sensex stocks?

Ans. Another measurement is the dividend yield, which is defined as the relative size of yearly dividend payments compared to the share price. Higher dividend yields may attract income funds and other specialized funds which could lead to an increase in demand for the stocks and therefore could have positive implications for Sensex.

Q23. What role does RBI policy play in Sensex movements?

Ans. Sentiments regarding RBI policies have a significant influence over the Sensex because changes in these policies directly influence the growth, inflation rate, and overall liquidity in the economy. The most notable of these is with regard to interest rates and monetary policies. Flows depend on the market habits and the mood of investors, which might shift with policy developments.

Q24. Are Sensex returns taxable?

Ans. Any investment made out of the profits and profits earned through Sensex-based securities is ok for taxes. As such, when investing in mutual funds or exchange-traded funds (ETFs), capital gains from the sale may be short-term or long-term benefits depending on the holding period.

Q25. How does corporate earnings season affect Sensex?

Ans. Due to investors’ reaction towards the reported performance for each specific quarter, the Sensex becomes sensitive to the earnings season. While negative earnings or even losses may lead to falls which depict the mood of the market, positive earnings may push up the Sensex.

Q26. What are the risks of investing in Sensex?

Ans. Among those risks are market instability, economic downturn, political volatility, and fluctuations in rules and regulations. However, one of the weaknesses of Sensex is that it is quite trading-oriented and is made up of a few businesses which may affect it due to sector-specific issues.

Angel One (Trading & Demat Account)

Angel One (Trading & Demat Account)